The Benefits of Incorporation: Why Your Business Needs It

Posted on December 18th, 2023

In the fast-paced world of entrepreneurship, making the right decisions for your business is paramount to its success. One of these crucial decisions is whether or not to incorporate your business. Incorporation is more than just a legal step; it's a strategic move that can yield significant benefits for your company. In this comprehensive guide, we will delve into the multitude of advantages that incorporation brings and explain why your business needs it.

Asset Protection: Safeguarding Your Hard-Earned Wealth

The primary and most important advantage of incorporating is the safeguard it provides for your personal assets. As a sole proprietor or general partner, your personal assets are intimately linked to your obligations. In the event of legal matters, debts, or lawsuits, assets like your home and savings could be in jeopardy. Incorporation establishes a legal division between your personal and company assets, protecting your personal wealth from potential claims related to the entity.

Moreover, by forming a corporation or an LLC (Limited Liability Company), you limit your personal liability. This means that your personal assets are generally protected from business debts and legal actions, allowing you to take more calculated risks and grow your business with confidence. Asset protection is not just a perk; it's a fundamental reason why incorporating your business is a wise choice.

Tax Benefits: Maximizing Your Profits

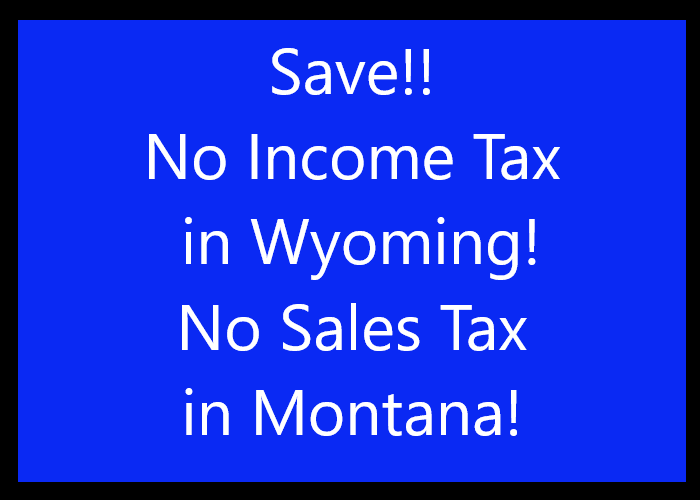

Another compelling reason to incorporate your business is the potential for significant tax benefits. Different business structures, such as C Corporations and S Corporations, offer various tax advantages that can reduce your tax liability and increase your profits. For instance, C corporations can deduct certain business expenses, enjoy tax-deferred savings, and offer more flexibility in employee benefits. On the other hand, S corporations and LLCs allow income to pass through to the owners' personal tax returns, potentially lowering the overall tax burden.

Comprehending these tax advantages and selecting the appropriate organizational structure can lead to significant savings for your enterprise. Collaborating closely with tax professionals and experts in organizational development allows you to craft a tax plan that aligns with your strategic objectives, guaranteeing the retention of a larger portion of your earnings.

Enhanced Credibility: Building Trust in Your Brand

Perception holds considerable weight in the corporate realm, and formalizing your enterprise can notably elevate your reputation and level of professionalism. Clients, customers, and collaborators frequently regard incorporated entities as more steadfast and dependable. The 'Inc.' or 'LLC' designation following your company name can instill assurance in prospective partners and investors.

Furthermore, incorporation can open doors to opportunities that might be unavailable to unincorporated businesses. Many organizations, including government agencies and larger corporations, prefer to work with incorporated entities for various reasons, such as liability protection and clear legal structures. By incorporating your business, you position yourself for growth and establish a solid foundation on which to build trust and credibility.

Access to Capital: Facilitating Business Expansion

As your business grows, you may find a need for additional capital to fund expansion, launch new products, or seize new opportunities. Incorporation can make it easier to raise capital through various means. Corporations, for example, can issue stock, making it more attractive to investors. Additionally, banks and lending institutions often favor incorporated businesses when extending loans or lines of credit due to their structured and regulated nature.

Furthermore, incorporating your business can pave the way for mergers, acquisitions, and partnerships, allowing you to tap into new markets and resources. The ability to attract investors and secure financing is a crucial aspect of long-term business success, and incorporation can be the key that unlocks these opportunities.

Perpetual Existence: Ensuring Business Continuity

One often overlooked but vital benefit of incorporation is the concept of perpetual existence. Unlike sole proprietorships or partnerships, which may dissolve with changes in ownership or the departure of key individuals, incorporated businesses have a life of their own. The business continues to exist even if there are changes in ownership, leadership, or shareholders.

This continuity is invaluable for businesses with long-term goals and aspirations. It ensures that your legacy and hard work can be passed on to future generations or seamlessly transitioned to new leadership without disrupting operations. Whether you plan to build a multi-generational family business or envision selling your company down the road, perpetual existence is a significant advantage of incorporation.

Easier Transfer of Ownership: Simplifying Succession Planning

Succession planning is a critical aspect of running a business, especially if you have plans to retire or pass on your business to heirs or partners. Incorporation simplifies the process of transferring ownership, making it more efficient and less cumbersome.

Incorporated businesses can issue shares of stock, making it easy to divide ownership among multiple stakeholders or transfer it to designated individuals. This flexibility allows for smoother transitions and ensures that the business remains intact even in the face of significant changes in ownership.

Conclusion

Incorporating is not merely a legal obligation but also a strategic decision that can offer numerous advantages. From safeguarding your personal assets to harnessing tax benefits and establishing trustworthiness, incorporation stands as a pivotal milestone on your path to success. At EZ Corp Services, we excel in guiding enterprises similar to yours through the complexities of incorporation and registered agent solutions. Our mission is to offer professional direction, customized resolutions, and individualized support to ensure your journey toward prosperity is a smooth one.

Ready to reap the benefits of incorporation? Reach out to us today at (307) 275-0000 or email us at wyezcorp@gmail.com. Let's work together to make your business dreams a reality with EZ Corp Services by your side. Don't wait—your business's success story starts now.

Free Consultation

Get Your Free Consultation

Reach out to us today to discuss how we can help you unleash your business's full potential. Let's make your entrepreneurial dreams a reality with EZ Corp Services!

Have a couple of quick questions? Text 307-363-0059